What is a Demat Account?

A Demat Account, short for Dematerialized Account, is an electronic account that holds shares and securities in a digital format. It eliminates the need for physical share certificates and allows for easy and convenient trading and investment in the stock market. Investors can buy, sell, and transfer securities such as stocks, bonds, and mutual funds through their Demat Account.

How to Open a Demat Account with HDFC Bank

Opening a Demat Account with HDFC Bank is a straightforward process that can be completed online. To begin, visit the HDFC Bank website and navigate to the Demat Account section. Follow the instructions to fill out the online application form, providing necessary personal and financial details. Once the form is submitted, you may be required to verify your identity and address through Aadhaar-based e-KYC or by submitting physical documents. After verification, your Demat Account will be opened, and you will receive your account details and login credentials.

Charges and Documents Required

When opening a Demat Account with HDFC Bank, it’s essential to be aware of the associated charges. These may include account opening fees, annual maintenance charges, transaction fees, and other applicable fees. Additionally, you will need to provide certain documents such as proof of identity, proof of address, PAN card, and passport-sized photographs to complete the account opening process.

Benefits of Opening a Demat Account with HDFC Bank

Opening a Demat Account with HDFC Bank offers numerous benefits to investors. These include seamless and paperless trading, secure storage of securities, easy tracking of investments, and simplified portfolio management. Additionally, HDFC Bank provides access to research reports, market insights, and investment advisory services to help investors make informed decisions.

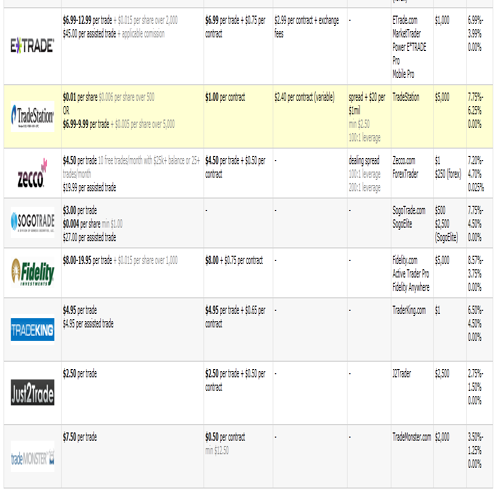

Factors to Consider When Choosing a Broker

When choosing a broker for your Demat Account, it’s important to consider factors such as brokerage fees, customer service quality, research and analysis tools, trading platforms, and the broker’s reputation in the market. HDFC Bank is known for its competitive brokerage rates, robust trading platforms, and excellent customer support, making it a popular choice for investors.

Use the share button below if you liked it.

It makes me smile, when I see it.