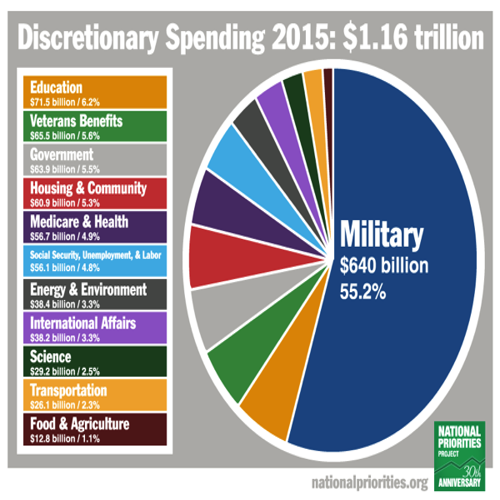

Impact of Extended Furloughs and Weak Discretionary Spending

Extended furloughs and weak discretionary spending are expected to have a significant impact on the revenue of IT companies in the December quarter. With businesses prioritizing essential expenses and reducing non-essential spending, IT services that fall under discretionary categories are likely to experience a decline in demand. This trend is further exacerbated by extended furloughs, leading to reduced productivity and project delays.

Analysts’ Percentage Decline Estimates for IT Companies

According to Kotak Institutional Equities, analysts have estimated specific percentage declines for each of the mentioned IT companies. The predictions indicate varying degrees of revenue decline, with each company facing unique challenges in the current economic landscape. These estimates provide valuable insights into the potential financial performance of individual IT companies in the upcoming quarter.

Anticipated Weak Quarter for the IT Services Sector

The overall outlook for the IT services sector in the December quarter is characterized by anticipated weakness. Factors such as extended furloughs, weak discretionary spending, and cost-cutting measures contribute to a challenging operating environment for IT companies. The anticipated weak quarter underscores the need for strategic adjustments and proactive measures to mitigate the impact on financial performance.

Positive Developments and Future Projections

Despite the challenges outlined by Kotak Institutional Equities, there are some positive developments within the IT industry. For instance, there has been a reduction in the pace of pruning discretionary spending, indicating a potential stabilization of certain financial indicators. Looking ahead, analysts believe that the scenario is likely to improve from the March 2024 quarter, offering a glimpse of optimism amidst the current challenges.

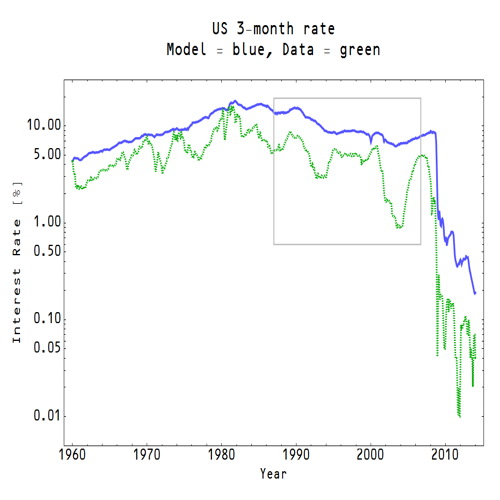

Cautionary Notes on IT Stocks Rally and Rate Cut Expectations

The recent rally in IT stocks, driven by expectations of a rate cut, has prompted cautionary notes from analysts. While the rally has generated optimism within the market, there are concerns that the extent of the rally may have been overly optimistic. It is essential for investors and industry stakeholders to carefully evaluate the potential impact of market dynamics and maintain a balanced approach in response to rate cut expectations.

Use the share button below if you liked it.

It makes me smile, when I see it.