What is a Demat Account?

A Demat Account, short for Dematerialized Account, is an electronic account that holds all the investments in securities such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs) in a dematerialized or electronic format. It eliminates the need for physical share certificates and facilitates easy and secure trading and investment in the stock market.

How to Open a Demat Account

Opening a Demat Account is a straightforward process. You can choose a bank or a brokerage firm that offers Demat Account services, fill out the account opening form, submit the required documents such as identity proof, address proof, and PAN card, and complete the in-person verification (IPV) process. Once the account is opened, you will receive a unique Demat Account number, which you can use to start trading and investing in securities.

Benefits of Having a Demat Account

Having a Demat Account offers numerous benefits, including paperless transactions, easy and quick transfer of securities, reduced risk of theft or damage to physical share certificates, access to electronic statements and transaction history, and the ability to participate in corporate actions such as dividends and bonus issues seamlessly. Additionally, it provides a single platform to hold various types of securities, making portfolio management more efficient.

Types of Demat Accounts

There are different types of Demat Accounts to cater to the specific needs of investors. Regular Demat Accounts are suitable for residents of India, while Non-Resident Indians (NRIs) can opt for either a Repatriable or Non-Repatriable Demat Account, depending on their repatriation requirements. Understanding the features and eligibility criteria of each type is essential to choose the right Demat Account that aligns with your investment objectives.

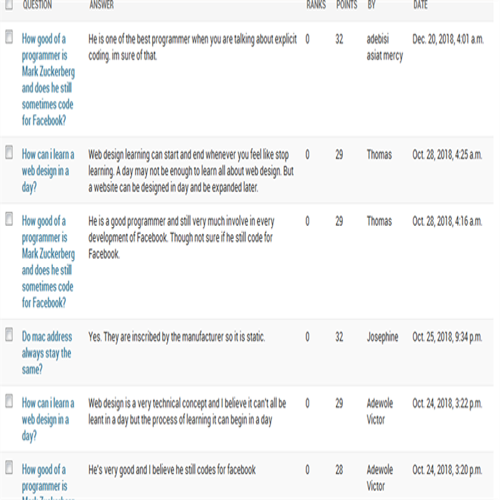

FAQs About Demat Accounts

As a beginner investor, you may have several questions about Demat Accounts. This section addresses common queries such as the charges associated with a Demat Account, the process of buying and selling securities, the role of Depository Participants (DPs), and the procedure for updating personal details in the account. By gaining clarity on these aspects, you can make informed decisions and make the most of your Demat Account.

Use the share button below if you liked it.

It makes me smile, when I see it.